georgia estate tax rate 2020

For 2020 the estate tax exemption is set. Georgia is ranked number thirty three out of the fifty states in order of the average amount of property.

Georgia Estate Tax Everything You Need To Know Smartasset

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

. The state of Georgia requires you to pay taxes if you are a resident or nonresident that receives income from a Georgia source. However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and 1206 million in 2022. 48-12-1 was added to read as follows.

Chatham County makes every effort to assure that the information presented on these web pages are up to date but to obtain the most accurate information you. Georgia estate tax rate 2020. Jurisdictions located in the state may charge additional sales taxes.

All property in Georgia is taxed at an assessment rate of 40 of its full market value. Over 2600 but not over 9450. Integrate Vertex seamlessly to the systems you already use.

The taxable value is then multiplied by the millage rate. The highest marginal tax rate in the state at 575. The tax rate works out.

Property is taxed according to millage rates assessed by different government entities. The millage rates below are those in effect as of September 1. Then you take the 1158 million number and figure out what the estate tax on that.

In Gwinnett County these normally include county county bond the detention center bond schools school bond recreation and cities where applicable. Georgia state income tax rate table for the 2020 2021 filing season has six income tax brackets with GA tax rates of 1 2 3 4 5 and 55 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

The rate remains 40 percent. Local governments adopt their millage rates at various times during the year. 2020 Federal Income Tax Brackets and Rates.

Over 9450 but not over 12950. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Heres how the estate tax rules work what the estate tax rates are and whether you may have to pay the state too plus tips for minimizing the.

If taxable income is. One mill equals 100 of property taxes for every 1000 of assessed valuation. Property is taxed according to millage rates assessed by different government entities.

What is the Georgia state tax rate for 2020. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. See what makes us different.

The median real estate tax payment in Georgia is 1771 per year about 800 less than the national average. 083 of home value. It applies to income of 13450 or more for deaths that occur in 2022.

Exemptions such as a homestead exemption reduce the taxable value of your property. 10 percent of taxable income. Georgia estate tax rate 2020 Thursday April 28 2022 Edit The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518400 and higher for single filers and 622050 and higher for married couples.

Georgia law is similar to federal law. Ad Automate Standardize Taxability on Sales and Purchase Transactions. TY 2019 2020.

The highest trust and estate tax rate is 37. The state also charges a 575 percent corporate tax rate on Georgia. The above income tax rates are for the 2021 tax year.

After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. We dont make judgments or prescribe specific policies.

1158 million for 2020 117 million for 2021 and 1206. The top Georgia tax rate has decreased from 575 to 55 while the tax brackets are unchanged from last year. 260 plus 24 percent of the excess over 2600.

Georgia Governor Brian Kemp recently signed a tax bill that. In 2022 Connecticut estate taxes will range from 116 to 12 with a. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that.

The state income tax rates range from 1 to 575 and the general sales tax rate is 4. Property taxes in Georgia are relatively low. Tax amount varies by county.

Georgia Department of Revenue. The tax rate schedule for estates and trusts in 2020 is as follows. Georgia state offers tax deductions.

The average effective property. 1 mill 1 tax per 1000 taxable value. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year.

For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple.

Tax Rates Gordon County Government

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

308 Lakeshore Dr Savannah Ga 31419 Zillow

Property Taxes Laurens County Ga

Georgia Income Tax Calculator Smartasset

Tax Rates Gordon County Government

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Filing Georgia State Taxes An Overview The Official Blog Of Taxslayer

Attotney David Galler Graduated In 1986 From Georgia State College Of Law For The Last 29 Years He Has Represented Thousands Debt Problem Chapter 13 Chapter

Taxes In Georgia Country Income Corporate Vat More

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Georgia Estate Tax Everything You Need To Know Smartasset

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

State Corporate Income Tax Rates And Brackets Tax Foundation

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation

Lic S Jeevan Shanti New Pension Plan Review How To Plan Shanti Investing

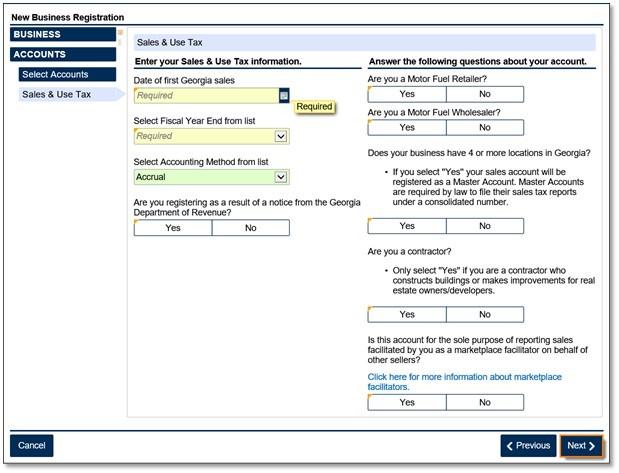

Marketplace Facilitators Georgia Department Of Revenue

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate