pay ohio county taxes online

5338 This service only accepts credit or debit cards and there will be a convenience fee added to the payment amount charged by Official Payments. Phone payments are available for real estate and manufactured home taxes by dialing 866 648-1955 via Point and Pays Intelligent Voice Recognition.

Buyer And Seller Terms Made Easy Terms Make It Simple Seller

Pay your real estate and manufactured home taxes online.

. There were no sales and use tax county rate changes effective July 1 2022. 2022 3 rd Quarter Rate Changes. Online Greene County property owners can pay their tax bills online using NIC online payment services.

Treasurers Office Policy for Pro-Rating Taxes. Real estate taxes are calculated annually by the County Auditor. I Want To.

Perry County Ohio First Half Real Estate Taxes Are Due March 11 2022 28 UPDATE - Now due March 18. Enter Taxpayer Account Number. Payments made online and by phone may take up to 48 hours to reach our office.

Enter Tax Year and Ticket Number and suffix. 105 Main Street Painesville OH 44077 1-800-899-5253. We will resume normal business hours on Tuesday September 6th from 800 am.

Failure to purchase the permit will result in a 100 fine for both the MH owner and the mover. There will be a convenience fee for this service that you will see before you submit your payment. Take advantage of our fast convenient payment options and pay your bills on time on your time every time.

Pay them simply quickly and securely with ACI Payments Inc. Property taxes are charged as mills. Update or change Your ADDRESS.

Box 188 Wheeling WV 26003 304 234-3688. How Ohio Property Taxes Work. If you are having difficulty paying your water bill or you have received late fees on your bill because of delay in.

Property Tax Due Dates. The Hamilton County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Hamilton County local sales taxesThe local sales tax consists of a 125 county sales tax. Pay Online or by Telephone.

ATTOM Data Solutions reports that the counties with the highest effective tax rate as of 2020. The convenience fee is paid to NIC Services not the Greene County Treasurer and is as follows. If you do not see your county and you feel this service would be beneficial to your county or if you have any other questions please feel free to drop us an email or contact us 1-256-275-4042.

Look up property valuation. To pay your Ad Valorem taxes by phone please call. Pay Cincinnati Parking Tickets.

Ways to Pay Online. An Emergency Rental Assistance program under the American Rescue Plan Act of 2021 which does not require COVID-related reasons runs through Sept. Must have parcel or registration number.

- The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. Therefore looking at specific counties will give you a better sense of how high property taxes can actually get. Online Access to Defiance County Government.

FIS adds a service fee of 235 with a minimum of 195 for. Water Customer Service Hours open to the public Monday through Friday 900 am. Tax Lien Sale.

Pay Traffic Tickets Court Costs. Sold Tax Lien Certificates. Online Tax Record Search Enter a search argument and select the search button Pay your taxes online Enter Taxpayer Name last first.

Payment Methods and Locations. Pay Taxes by Credit Card E-Check. The Franklin County Treasurers Office will be closed on Monday September 5th for Labor Day.

Ohio residents pay a base tax rate of 10 mills. The Highest Property Taxes by County. The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office.

Is a leading provider of digital payment solutions for the IRS as well as states municipalities colleges and universities nationwide. - Map of current sales tax rates. Government services arent always free and waiting in line can be a pain.

The Board of County Commissioners approved a Clermont County Job and Family Services contact with Clermont County Community Services to administer the Emergency Rental Assistance Fund. Real Estate Tax by Credit CardeCheck. While it can help to consider state averages property taxes are typically set at the county level.

216 529-6820 Option 2. PAY YOUR TAXES Online Pay your property taxes or manufactured home taxes online in three simple steps. Payment Plans Ask how to set up a payment plan to pay delinquent taxes.

Ohio County Sheriffs Tax Office 1500 Chapline St. That is lower than the. Property taxes in Ohio pay for important local services like schools police departments and parks.

The Hamilton County Sales Tax is collected by the merchant on all qualifying sales made within Hamilton County. We are unable to accept credit card debit card or e. The successful bidder is required to pay the county treasurer a cash deposit or certified check money order bank draft or electronic transfer of funds of at least 10 of the certificate purchase price on the day of the sale.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien. Do I pay taxes. Please understand that most policies regarding real estate taxes are set by the Ohio Revised Code ORC.

1-800-272-9829 use jurisdiction code. Located in central Ohio Stark county has property taxes far lower than most of Ohios other urban counties. In fact the countys average effective property tax rate is just 142.

Yes a new law passed in 2000 requires a permit to move a mobile or manufactured home. Pay Water Sewer Bill. Credit card debit card and electronic check payments can be made on our website.

One mill is one-thousandth of a dollar - this equates to one-tenth of a cent or 001. Electronic payments are processed by FIS a service provider for Butler County. The cost is 500 and is purchased in our office.

Groceries are exempt from the Hamilton County and Ohio state sales taxes. There were no sales and use tax county rate changes effective October 1 2022. Pay Property Real Estate Taxes.

Pay A Tax Bill. Board of County Commissioners. CLERMONT COUNTY OHIO CLERMONT COUNTY OHIO.

Agendas And Meeting Info. The citys Public Works Department delivers safe high-quality water and reliable wastewater service to all Lakewood residents and businesses. Debit or Credit Card - 22 of the amount plus.

101 E Main St Batavia OH 45103. Look up tax rates by taxing district. 1st Half 2022 PAY 2023 Real Estate Tax.

Select your county on the right and pay your property taxes now.

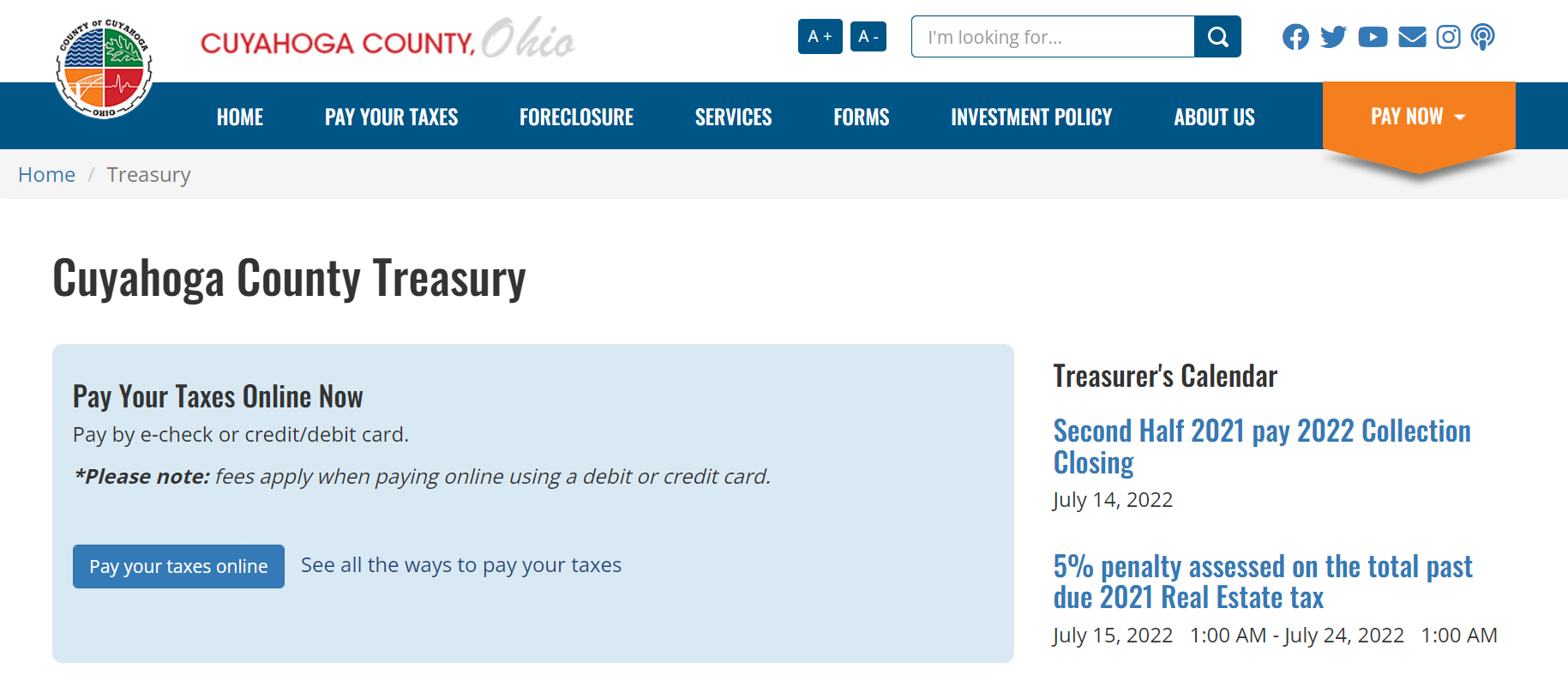

New Portal Makes It Easier To Pay Cuyahoga County Tax Bills Online Cleveland Com

Panda Property I Buy Houses Cash Macomb Flyer Real Estate Investing Wholesaling Real Estate Tips We Buy Houses

Online Only Absolute Auction At 427 Walden Avenue Toledo Ohio 43605 Bidding Ends Fr Hardwood Floors In Kitchen Forced Air Heating The University Of Toledo

Ohio Survive Divorce Divorce Collaborative Divorce Dissolution Of Marriage

How To Calculate Sales Tax For Your Online Store

Find Tax Help Cuyahoga County Department Of Consumer Affairs

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Real Estate Tips Real Estate Education Real Estate Terms

Bank Owned Auction Minimum Bid 100 000 At 4756 4760 N Summit Toledo Oh 43611 On Fri Dec 4 At 12 Bank Owned Properties Commercial Property Luxury Design

Rentals Have Nearly Doubled Over The Past Year In Phoenixarizona In 2022 Vote Democrat Informative Hawthorne

New Portal Makes It Easier To Pay Cuyahoga County Tax Bills Online Cleveland Com

Ohio Sales Tax Small Business Guide Truic

New Portal Makes It Easier To Pay Cuyahoga County Tax Bills Online Cleveland Com

Online Duplex Auction Minimum Bid 39 900 Sells At The Minimum Or Above Great Investment Identical Real Estate Auction Residential Real Estate House Styles

Franklin County Treasurer Home

Simple Purchase Agreement Template Stcharleschill Template Contract Template Purchase Agreement Good Essay

Pay Online Department Of Taxation

Who Does Rent To Own Work Rent Rent To Own Homes Lease Option

Real Estate Blog Mortgage Payment Property Tax Florida Real Estate