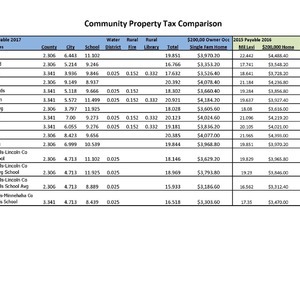

south dakota property tax rates by county

If your taxes are delinquent you will not be able to pay online. The average yearly property tax paid by Tripp County residents amounts to about 191 of their yearly income.

Sales Use Tax South Dakota Department Of Revenue

The median property tax also known as real estate tax in Douglas County is 102200 per year based on a median home value of 5830000 and a median effective property tax rate of 175 of property value.

. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. Custer County South Dakota. Convenience fees 235 and will appear on your credit card statement as a separate charge.

Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000 102 of median home value per year. To compare Codington County with property tax rates in other states see our map of. The winning bidder is the one willing to pay the most for the tax lien.

Second half are due by October 31 st. Put another way if you live in Minnehaha County you can expect to pay 1290 for every 1000 of real estate value. Taxes that accrue in 2019 are due and payable in 2020 Tax notices are mailed by mid-February.

The median property tax also known as real estate tax in Custer County is 155400 per year based on a median home value of 16070000 and a median effective property tax rate of 097 of property value. In the year 2020 property owners will be paying 2019 real estate taxes Real estate tax notices are mailed to the property owners in either late December or early January. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

This interactive table ranks South. To compare Haakon County with property tax rates in other states see our map of. The typical homeowner here pays 2535 in property taxes each year.

First half property taxes are due by April 30 th. In addition all taxes under 50 are due and payable in. Tripp County collects on average 13 of a propertys assessed fair market value as property tax.

33 rows South Dakota. SDCL 10-24-1 Person can redeem property sold at sale at any time before tax deed is issued amount to. The money from the taxation of these vehicles is collected and remitted to the state of South Dakota.

The county treasurer also collects property taxes for the county city school districts and any other political district authorized to levy real estate taxes. The exact property tax levied depends on the county in South Dakota the property is located in. Brown County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Real Estate taxes are paid one year in arrears. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000 102 of median home value per year. To view all county data on one page see South Dakota property tax by county.

Redemption from Tax Sales. In South Dakota tax collectors sell tax lien certificates to the winning bidders at the delinquent property tax sales. The countys average effective property tax rate is 141.

See Results in Minutes. South Dakota does not have an inheritance tax. Median property tax is 162000.

Learn About Owners Year Built More. Of the sixty-six counties in. Of that 14 billion or 203 of the total revenue collected comes from property taxes.

Depending on where the property is located the homeowner has approximately three 3 or four 4 years from the date the tax lien certificate was. Special assessments are due by April 30 th also. Compared to the state average of 129 homeowners pay an average of 000 more.

This eastern South Dakota county has the highest property taxes in the state. Out of the 66 counties in South Dakota Minnehaha County has the 17th highest property tax rate. The voters of South Dakota repealed the state inheritance tax effective July.

It contains Rapid City the second-largest city in South Dakota. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of. Inheritance and Estate Taxes.

Ad Look Up Any Address in South Dakota for a Records Report. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home value.

Real estate taxes are paid one year in arrears. Douglas County South Dakota. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed including taxes interest penalties and additional costs incurred.

South Dakota property taxes are based on your homes assessed value as determined by the County Director of Equalization. Municipalities may impose a general municipal sales tax rate of up to 2. The median property tax in Tripp County South Dakota is 900 per year for a home worth the median value of 69400.

Please call the Treasurers Office at 605 367-4211. Then the property is equalized to 85 for property tax purposes. The first half of your real estate taxes are due by midnight on April 30 th.

The median property tax also known as real estate tax in Brown County is 166100 per year based on a median home value of 11570000 and a median effective property tax rate of 144 of property value. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax.

If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000 102 of median home value. Custer County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax.

Overview of Minnehaha County SD Property Taxes. You can use the South Dakota property tax map to the left to compare Bennett Countys property tax to other counties in South Dakota. Find Details on South Dakota Properties Fast.

Douglas County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax. The South Dakota Department of Revenue administers these taxes. A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500.

Historical South Dakota Tax Policy Information Ballotpedia

North Dakota Property Tax Calculator Smartasset

How Are Property Taxes Calculated Plains Commerce Bank

South Dakota Is A Low Tax State Overall But Not For Families Living In Poverty Itep

Property Tax South Dakota Department Of Revenue

Sales Use Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

State Tax Treatment Of Homestead And Non Homestead Residential Property

South Dakota Sales Tax Rates By City County 2022

Tax Information In Tea South Dakota City Of Tea

South Dakota Landlord Tenant Laws Updated 2020 Payrent

South Dakota Property Tax Calculator Smartasset

South Dakota Sales Tax Small Business Guide Truic

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)